capital gains tax canada crypto

In other words if you made 100 from crypto activity. How is crypto tax calculated in Canada.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The amount of tax you pay on crypto in Canada depends on whether you are considered to be operating a crypto business or simply trading crypto for capital gains.

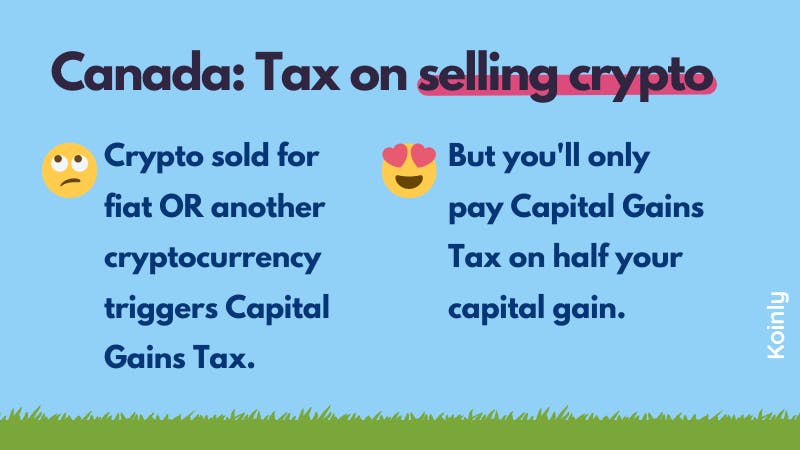

. The gains made on crypto. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains. In Canada 50 of your capital gains are taxable.

If the sale of a cryptocurrency does not constitute carrying on a business and the amount it sells for is more than the original purchase price or its adjusted cost base then the taxpayer has. The distinction is important because business income is fully taxable whereas only 50 of capital gains are taxable. Taxes on margin and.

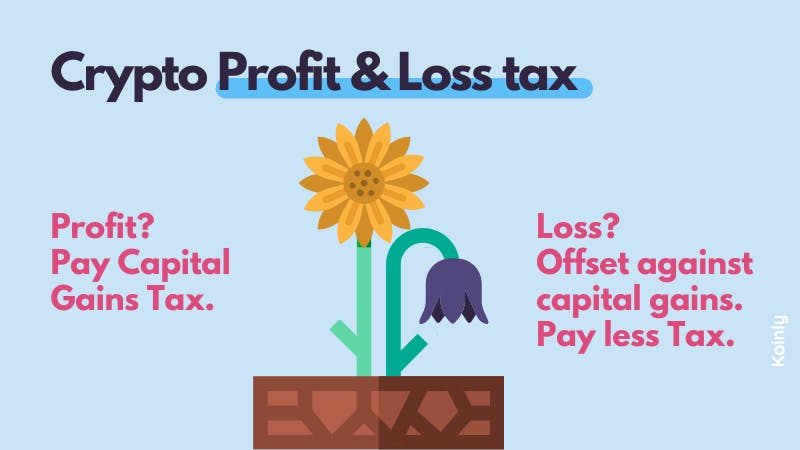

However just as only 50 of. Cryptocurrency earnings are treated as a capital gain or business income meaning that you will have to pay capital gains tax or income tax. Cryptocurrency gains can be offset by capital losses.

However it is important to note that only 50 of your capital gains are taxable. The CRA says Capital gains from the. The CRA makes it clear that crypto is subject to either Income Tax or Capital Gains Tax - depending on whether youre seen to be conducting business-like activities or acting as an.

If your activity falls under capital gains hobby you only pay tax on 50 percent of the newly-acquired capital. Tax on Crypto in Canada. In Canada these two different forms of incomebusiness income vs.

So of the 40000 profit you made upon selling you would have to report 20000 as income for your. If your earnings qualify as capital. Your capital gain is 40000 CAD.

In almost every country today individuals have to calculate and pay capital gains tax if dealing with cryptocurrencies and other assets. Half of his capital gain is subject to tax taxable capital gain 750 which he needs to report on his tax return to the Canada Revenue Agency in 2021. Just like regular capital gains and losses keeping track of your cryptocurrency earnings and losses can be very helpful.

Cryptocurrency is taxed as capital gains If you are using cryptocurrency to invest you will be taxed on the capital gains when you sell it. Cryptocurrencies are taking the financial world by storm and leaving a lot of Canadian investors confused about the correct way to report their crypto on their Canadian. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes.

Similarly if you incur losses these are treated as either business losses or capital losses for tax purposes. If you are reporting them as capital gains you need to fill out the. Crypto tax rates range from 0 to 37 depending on several factors including whether your cryptocurrency is taxed as ordinary income short-term capital gains or long-term.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity. For example you started 2021 with 10000 worth of crypto and by.

Valuing cryptocurrency as inventory. If you are reporting your crypto transactions as business income you will need to fill out form T2125 with your tax return. If you sell any cryptocurrency assets for less than the cost you paid for them you can count this as a capital loss and use it to offset your total capital gains.

When it comes time to file your capital gains taxes youll have. For Canadian individuals the CRA has. In Canada the rate of capital gains tax is not specific in fact there is no long-term or short-term capital gains tax rate.

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

The Ultimate Guide To Canadian Crypto Tax Laws For 2022 Zenledger

Crypto Price Analysis January 22 Btc Eth Bsv Bch Ltc Coinspeaker Cryptocurrency Bitcoin Blockchain

Coincub S Top Ten Global Crypto Economies For 2021 Q4 Agree Coincub Released Yesterday The Top 10 Of The World S Most Progre Global Financial Services Japan

Cryptocurrency Wipeout Deepens To 640 Billion As Ether Leads Declines Cryptocurrency Bitcoin Price Bitcoin

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Get The Insight On The Crypto Revolution With Capital Com Find Out What A Cryptocurrency Is And How It Works All About Cr Cryptocurrency Graphing Infographic

Canada Crypto Tax The Ultimate 2022 Guide Koinly

What Is Cryptocurrency How Does Crypto Impact Taxes H R Block

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

![]()

What Is My Tax Rate For My Crypto Gains Cointracker

How To Use Binance Beginner S Guide Beginners Guide Beginners How To Get Rich

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Https Www Google Com Blank Html Gold Coins Buy Gold And Silver Gold

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How To Cash Out Crypto Without Paying Taxes In Canada Aug 2022 Yore Oyster

10 Best Cryptocurrencies Of July 2022 In 2022 Best Crypto Buy Cryptocurrency Capital Market